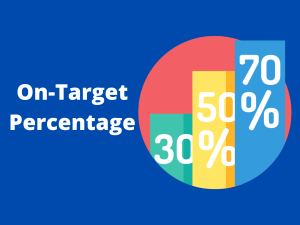

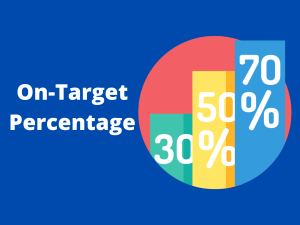

On-target percentage, also called OTP, measures how much of your advertising campaign’s results actually stem from your intended audience.

Table of Contents

on September 11, 2018

Think the days of TV are behind us? Think again. Connected TV is poised to explode in 2018, fueled by a virtuous cycle of rapid consumer uptake and an ecosystem that’s eager to deliver. As changing tastes and novel technologies push us into brave new territory, connected TV looks set to be one of this shifting media landscape’s landmark channels.

More and more viewers agree if the latest reports from Nielsen and the Interactive Advertising Bureau (IAB) are anything to go by. By the second quarter of 2017, 58.7% of Nielsen-covered households owned at least one internet-enabled, content-streaming device — be it a smart TV, a net-capable game console, or another device like Roku or Chromecast that can stream content to a TV screen. All in all, that translates to around 69.5 million households already on the connected TV.

There will soon be more. Connected TV usage jumped over 20% going into 2016, and the fraction of viewers who used TVs mostly for streaming digital content doubled (from 11% to 22%) between 2015 and 2017. Market studies predict that there will be 97.7 million US households, or 194.4 million viewers, with connected TVs by 2020.

What’s worth noting is that the technology is developing to consolidate these consumer shifts and embed connected TVs in viewers’ everyday routines. Today’s televisions go far beyond the old idea of TVs as a box for viewing whatever networks happened to put on. Now, connectivity and massive leaps in tech have reshaped TVs into command centers for consumers’ lives, virtual or otherwise. The risk of waning consumer usage lessens as each innovation turns connected TV into an essential feature of modern homes.

At CES 2018, for example, top manufacturers like LG and Samsung strove to turn their latest TVs into dedicated hubs for consumers’ personal internet-of-things (IoT) setups. The immediate future promises units equipped with Google Assistant and Alexa; large-display integrations with everything from smart lamps to home security systems; and more.

This is not to say that connected TV is outgrowing its roots. Content providers continue to devote resources to the connected TV wave. We saw the launch of YouTube TV and Hulu’s Live TV towards the end of 2017, for example. These two over-the-top (OTT) services are only the latest entrants to the robust ecosystem of digital and OTT content that continues to drive the connected TV market’s growth. To wit, from 3.6 hours in 2014, US audiences are now on track to spend an average of 18.9 hours per week on OTT content — a staggering 245% increase.

Here’s an even more impressive number, though: Ad revenues from connected TV are expected to reach $31.5 billion this year. That’s a 275% increase from 2015, which closed with a total of $8.5 billion.

That uptick in connected TV usage times is one big factor. As viewers tune in for longer periods and providers move more towards long-form content, ad time increases. Subsequently, average ad lengths for connected TV content are expected to rise from 3.2 minutes in 2014 to 5.1 minutes by 2020.

What’s more, connected TV lends itself well to a variety of advertising options. Marketers can use custom sponsorships and branded content alongside, say, programmatic ad transactions. Similarly, a campaign can mix more traditional linear video ads with interactive and dynamic ones to boost audience engagement.

The good news is that investment in connected TV advertising can lead to significant payoffs, as audiences have been observed to be more engaged and receptive when watching digital streaming content. Viewers of digital content are less likely to multitask compared to traditional TV audiences, for example.

More importantly, ads are emerging as the preferred way forward when it comes to business models for connected TV Marketing. Though the success of services like Netflix has spurred even broadcast networks to launch their own subscription-based digital content services, the latest consumer research shows that more and more consumers are lapsing into “subscription fatigue.” Around half of the connected TV owners now say that they prefer watching commercials over ad-free subscriptions when it comes to streaming video.

With connected TV offering much of digital’s targeting possibilities, the market seems like fertile ground for advertisers. Rich viewership data allows advertisers to cross-reference data across households’ connected devices, collate service usage records based on personally identifiable information, and ultimately launch precisely targeted campaigns. Connected TV’s integration into users’ personal network of devices also opens more spaces for cross-channel campaigns: advertisers can follow users from their connected TVs to related screens, serving complimentary ads on smartphones, perhaps, or incorporating branded content into their apps.

As promising as connected TV’s data-rich and the networked system might be, though, this also leads to some of the biggest challenges for marketers targeting the space.

Data collection methods raise questions about privacy, which can color users’ attitudes toward connected TV and related advertising. Similarly, the wealth of potential data, the fragmentation of the streaming content space, and the lack of standardized metrics pose problems of accuracy and attribution when it comes to measuring campaign effectiveness.

To illustrate, connected TV doesn’t have cookies — so advertisers must replace the web’s cookie-powered individual tracking with household-level tracking based on IP address-matching. This imprecision makes it difficult to run granular ad targeting at scale.

The fragmentation of services and devices compounds the problem. Unlike traditional linear programming, connected TV lends itself more towards “bubbles” or “pockets” of audiences: a certain target demographic, for example, might be scattered across several streaming networks, each of which would require separate advertising buys.

Signs point to 2018 being a connection to TV year. The market faces its share of challenges, especially when it comes to scaling, but brewing trends like the subscription model slowdown paint a promising future for digital marketing in this sphere. With streaming, audiences continuing to grow, and technology developing to support that, connected TV might well be digital advertising’s next big goldmine.

Featured Posts

On-target percentage, also called OTP, measures how much of your advertising campaign’s results actually stem from your intended audience.

Check out this infographic below that depicts a fascinating history of television advertising!

The Video Multiple Ad Playlist, or VMAP, is part of the Interactive Advertising Bureau’s Video Suite, a collection of protocols that standardize key aspects of the video ad delivery process.

Video marketing is on the rise, and by 2018, more than 60% of all internet traffic is expected to be video. Of that rise, a big chunk is driven by programmatic advertising, especially real-time bidding (RTB).

Adding {{itemName}} to cart

Added {{itemName}} to cart